Possible breach of resistance level by US Tech 100 Index

US Tech 100 Index is moving towards a resistance line which it has tested numerous times in the past. We have seen it retrace from this line before, so at this stage it isn’t clear whether it will breach this line or rebound as it did before. If US Tech 100 Index continues in its […]

What’s going on with Apple Inc.?

Those of you that are trend followers are probably eagerly watching Apple Inc. to see if its latest 12.08% move continues. If not, the mean-reversion people out there will be delighted with this exceptionally large 10 days move.

Support line breached by US Wall Street 30 Index

US Wall Street 30 Index has broken through the support line which it has tested twice in the past. We have seen it retrace from this line before, so one should wait for confirmation of the breakout before trading. If this new trend persists, a target level of around 34097.4644 may materialize within the next […]

Will US Small Cap 2000 Index have enough momentum to break resistance?

US Small Cap 2000 Index is heading towards the resistance line of a Rising Wedge and could reach this point within the next 2 days. It has tested this line numerous times in the past, and this time could be no different from the past, ending in a rebound instead of a breakout. If the […]

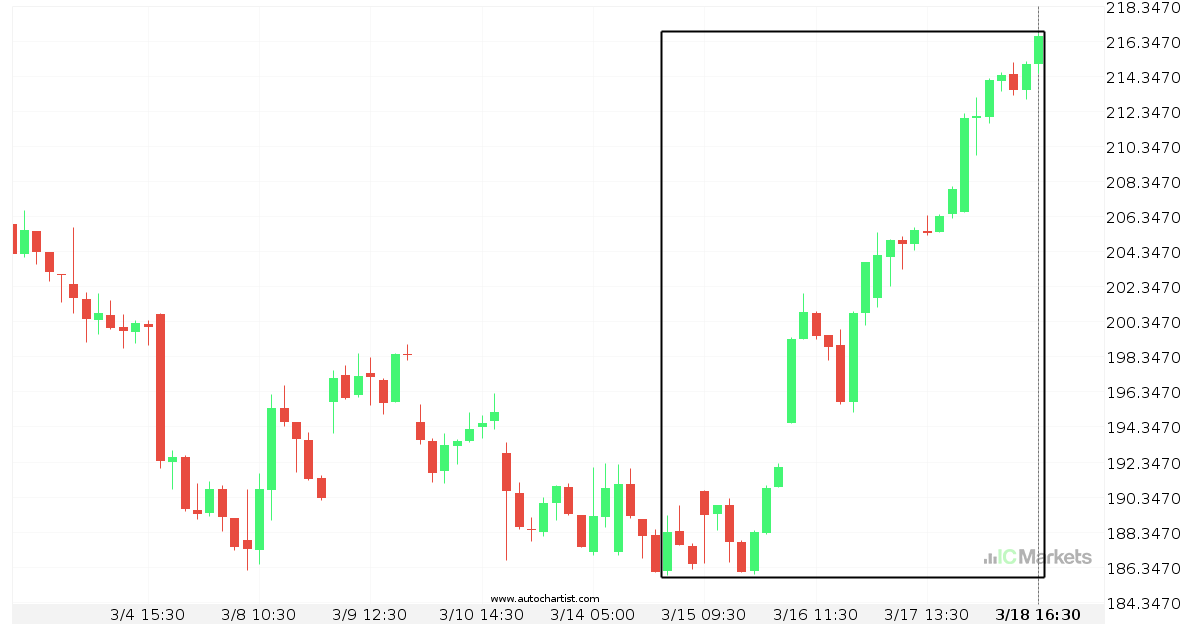

What’s going on with FACEBOOK?

Those of you that are trend followers are probably eagerly watching FACEBOOK to see if its latest 15% move continues. If not, the mean-reversion people out there will be delighted with this exceptionally large 5 days move.

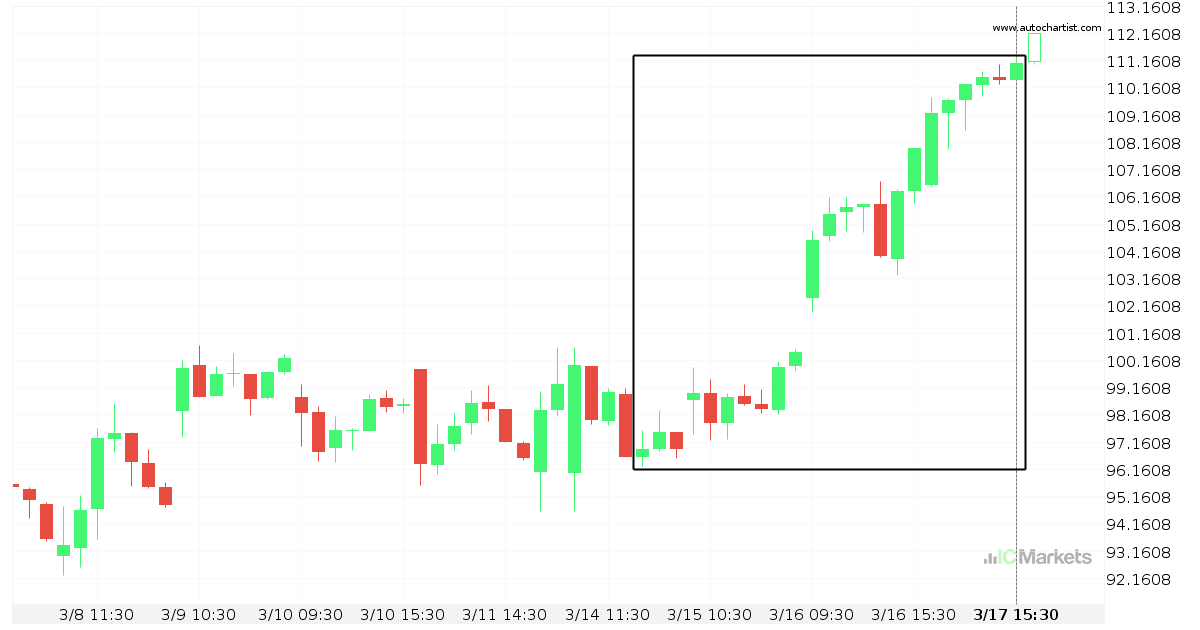

Paypal Holdings Corp is on its way up

Paypal Holdings Corp has experienced an exceptionally large movement higher by 14.6% from 96.6 to 111.04 in the last 4 days.

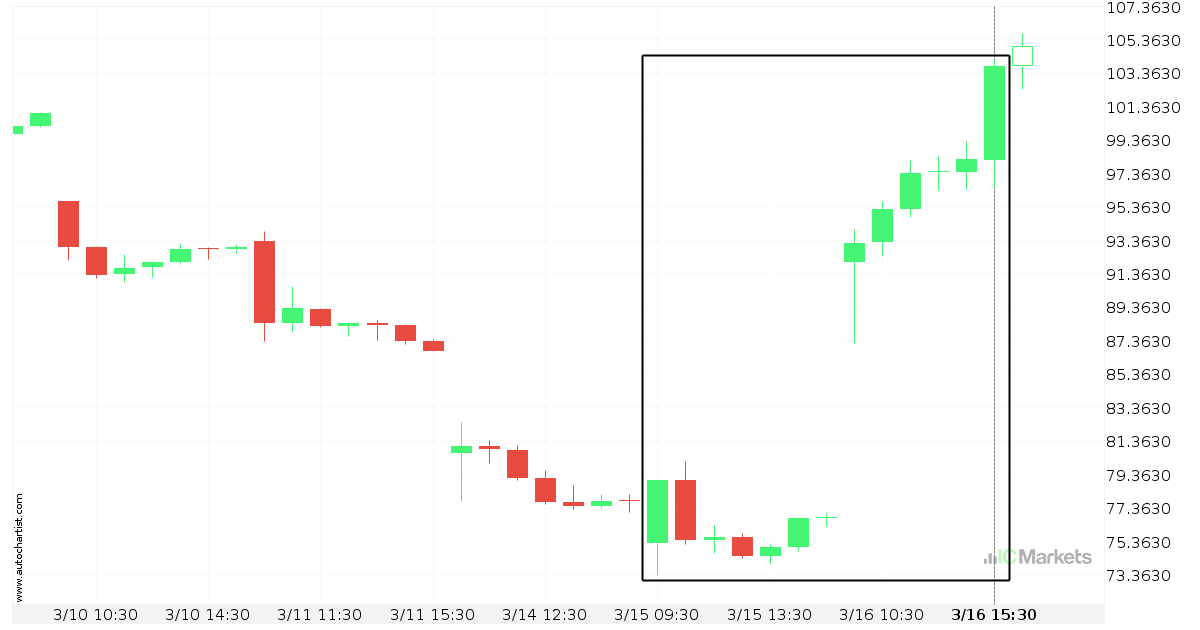

What’s going on with Alibaba Group Holding Limited?

Those of you that are trend followers are probably eagerly watching Alibaba Group Holding Limited to see if its latest 31.38% move continues. If not, the mean-reversion people out there will be delighted with this exceptionally large 2 days move.

US Tech 100 Index – resistance line breached

US Tech 100 Index has broken through the resistance line of a Falling Wedge technical chart pattern. Because we have seen it retrace from this line in the past, one should wait for confirmation of the breakout before taking any action. It has touched this line twice in the last 13 days and suggests a […]

Will US Wall Street 30 Index have enough momentum to break resistance?

US Wall Street 30 Index is heading towards the resistance line of a Falling Wedge and could reach this point within the next 17 hours. It has tested this line numerous times in the past, and this time could be no different from the past, ending in a rebound instead of a breakout. If the […]

Should we expect a breakout or a rebound on US Small Cap 2000 Index?

The movement of US Small Cap 2000 Index towards 2022.9301 price line is yet another test of the line it reached numerous times in the past. We could expect this test to happen in the next 2 days, but it is uncertain whether it will result in a breakout through this line, or simply rebound […]